The Battle for Private Listings: How Compass, Zillow, and ThePLS.com Are Reshaping the Future of Real Estate Marketing

📌 1. Compass vs. Zillow: The "Zillow Ban" Legal Showdown

What’s happening:

-

Zillow’s rule (effective June 30, 2025): Any publicly marketed home must go live on an MLS—and thus Zillow—within one business day or be banned from Zillow/Trulia permanently

-

Compass’s response: They've sued Zillow for antitrust violations, arguing Zillow is abusing dominance to outlaw private or off-market ("pocket" or "pre-market") listings that Compass uses strategically

-

Key arguments:

-

Compass says: Private pre-marketing lets sellers “test the waters,” manage pricing, avoid unwanted public scrutiny like Zestimate pressure, and even maintain dual commissions.

-

Zillow counters: It champions transparency and marketplace fairness—arguing banning fragmented listing practices helps all buyers access inventory and protects smaller brokerages

-

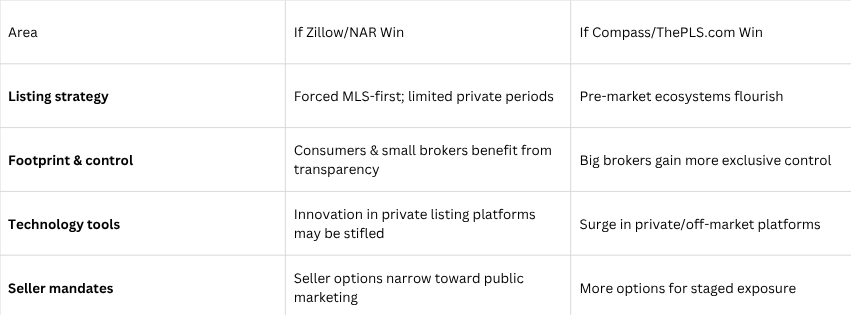

Possible outcomes:

-

Injunction in favor of Zillow: Private listings would effectively be banned unless pre-registered in MLS—killing broker pre-market strategies.

-

Court blocks Zillow’s ban: Compass could keep its system, potentially prompting other brokerages to follow suit.

-

Settlement or policy tweak: Platforms might agree to allow “soft premieres” for a short window before mandating MLS posting.

Implications for agents:

-

If Zillow wins, private/pocket listing tactics could be legally curtailed, benefiting transparency but reducing flexibility.

-

If Compass prevails, expect a boom in broker-driven private networks—raising bar for agents to offer exclusive “quiet” launches.

2. ThePLS.com (Mauricio Umansky) vs. NAR: Reviving the Pocket Listing Fight

Who & what:

-

Mauricio Umansky’s platform, ThePLS.com, refiled an antitrust lawsuit (originally filed in 2020) on July 1, 2025, targeting the NAR and affiliated MLSs

-

The suit claims the Clear Cooperation Policy (CCP)—mandating listing on an MLS within one business day of any marketing—was enforced to stifle innovative off-market platforms like ThePLS.com

Key claims:

-

NAR and MLSs colluded to eliminate competition by imposing CCP

-

The policy unfairly maintains MLS/NAR dominance and limits seller/agent choice

Possible outcomes:

-

Court strikes CCP as anti-competitive: Opens doors to new private listing platforms and more flexible seller options.

-

NAR's policy stands: Reinforces centralized MLS/public listing dominance.

-

Partial revisions: Maybe exceptions for discreet listings (e.g., ultra-premium, tenant-occupied homes).

Implications for agents:

-

If ThePLS.com wins, agents could leverage new private platforms to offer discreet, agent-controlled marketing outside MLS rules.

-

If NAR holds ground, agents will remain largely bound to CCP requirements—private listings limited.

🚀 What This Means for Agents: The Road Ahead

🧭 Bottom Line for Agents

These lawsuits aren’t just headline news—they’re defining the future landscape for how you market homes. If public interest in transparency continues to win the court’s favor, agents will need to pivot away from private listings. But if competition law supports private networks, expect a reshaped market with tactical, confidential listing systems available to savvy brokers.

Expert tip: Stay agile. Whether it’s MLS timing, pre-market disclosures, or new platforms, keeping up with the final rulings will be critical to staying competitive and compliant in the evolving listing ecosystem.

Categories

Recent Posts

GET MORE INFORMATION